Teen Money Mastery: 1 Day Financial Literacy Workshop in Los Angeles, CA

Schedule

Thu, 08 Jan, 2026 at 09:00 am to Wed, 10 Jun, 2026 at 10:00 pm

UTC-08:00Location

regus CA, Los Angeles – Spaces Fine Arts | Los Angeles, CA

About this Event

Group Discounts:

Save 10% when registering 3 or more participants

Save 15% when registering 10 or more participants

About the course:

Duration: 1 Full Day (8 Hours)

Delivery Mode: Classroom (In-Person)

Language: English

Credits: 8 PDUs / Training Hours

Certification: Course Completion Certificate

Refreshments: Lunch, Snacks and beverages will be provided during the session

Course Overview:

This interactive one-day program introduces teens to essential money skills needed for real-life financial decision-making. The course simplifies budgeting, saving, spending, and responsible money management through practical examples and engaging activities. Teens learn how to make smart financial choices, plan for short-term and long-term goals, and understand how money works in daily life. Through relatable scenarios, they gain confidence in handling personal finances and building healthy financial habits early on.

Learning Objectives:

By the end of this course, you will:

- Understand how to manage money responsibly and make informed decisions.

- Build confidence in budgeting, saving, and everyday spending.

- Learn how banks, digital payments, and basic financial tools work.

- Develop healthy financial habits that support long-term goals.

- Gain practical skills to handle real-life money situations confidently.

Target Audience:

Teens interested in learning essential financial skills, money management, budgeting, and responsible financial decision-making.

Why is it the Right Fit for You?

This course provides teens with the financial knowledge they need to navigate real-life situations confidently. Through relatable examples and interactive sessions, we make financial concepts easy to understand and apply. Our hands-on approach ensures you not only learn the theory but also practise making smart decisions in realistic scenarios. With expert trainers simplifying complex topics, the course builds long-lasting money habits. It is designed to empower you with practical skills that will benefit your education, career, and personal life.

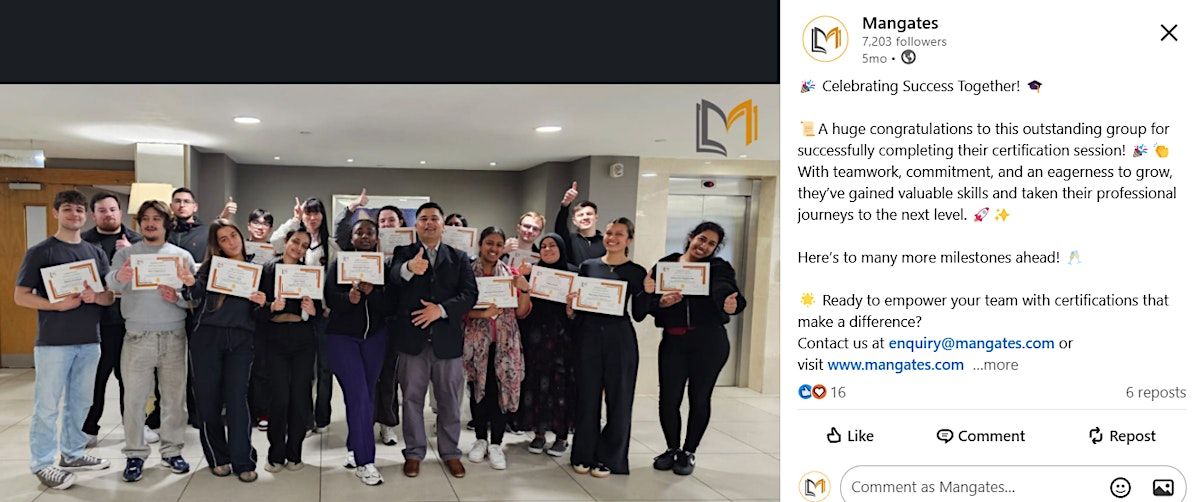

©2025 Mangates Tech Solutions Pvt Ltd. This content is protected by copyright law. Copy or Reproduction without permission is prohibited.

Our Royalty Referral Program

Know a team or professional who could benefit from our workshops? Refer them and earn attractive royalties for every successful registration.

For royalty-related queries, contact [email protected]

Looking to train a group of teens together?

We offer in-house training that can be customised to your organisation’s goals and financial literacy needs. Whether you want a stronger focus on budgeting, saving, or real-life simulations, we tailor the content to your group. In-house delivery ensures flexibility, consistency, and an engaging learning experience that aligns with your team’s objectives.

📧 Contact us today to schedule a customized in-house session:

Agenda

Module 1: Introduction to Money & Financial Basics

Info:

• Understanding the value of money

• How financial decisions impact daily life

• Key terms: income, expenses, savings

• Activity

Module 2: Budgeting for Teens

Info:

• Creating simple daily and monthly budgets

• Needs vs. wants

• Tracking expenses effectively

• Activity

Module 3: Smart Saving Habits

Info:

• Why saving is important

• Setting financial goals

• Methods of saving money

• Activity

Module 4: Spending Decisions & Money Choices

Info:

• Making responsible spending decisions

• Comparing prices and evaluating options

• Avoiding impulsive purchases

• Role Play

Module 5: Banking Basics

Info:

• Understanding bank accounts

• How deposits, withdrawals, and digital payments work

• Basics of interest and financial tools

• Activity

Module 6: Introduction to Earnings

Info:

• Different ways teens can earn money

• Understanding allowances, small jobs, and rewards

• Basics of managing earned money

• Activity

Module 7: Introduction to Investing Concepts

Info:

• What is investing?

• Risk vs. return (basic understanding)

• Long-term benefits of early investing

• Activity

Module 8: Real-Life Financial Scenarios

Info:

• Handling peer pressure and money choices

• Planning for future goals

• Making smart decisions in everyday situations

• Case Study

Where is it happening?

regus CA, Los Angeles – Spaces Fine Arts, 811 West 7th Street, Los Angeles, United StatesEvent Location & Nearby Stays:

USD 560.73 to USD 726.65