CRA Taxation Requirements for Sole Proprietors - January 28th, 2026

Schedule

Wed Jan 28 2026 at 02:00 pm to 04:00 pm

UTC-05:00Location

900 King St | London, ON

About this Event

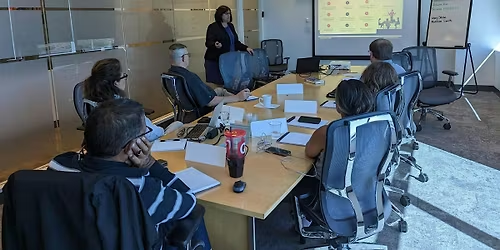

This IN-PERSON seminar will provide sole proprietors and unincorporated partnerships with a general overview of the relationship between their business and taxation.

The Liaison Officer T1 tax seminar is meant for newer small businesses or potential new start-ups. It also allows them to speak directly to a representative from the CRA to ask any questions they might have concerning business issues.

This 2-hour seminar will discuss the following:

• Common tax errors, what causes them and how to avoid them

• HST and Payroll

• Financial benchmarks for relevant industries

• Information on the CRA’s online services

• General bookkeeping concepts and best practices

Presented by the Canada Revenue Agency Liaison Officer

Where is it happening?

900 King St, 900 King Street, London, CanadaEvent Location & Nearby Stays:

CAD 0.00