The 1031 Exchange - What Title and Escrow Professionals Should Know

Schedule

Sat Apr 25 2026 at 09:00 am to 12:30 pm

UTC-07:00Location

RELAW, APC | Thousand Oaks, CA

About this Event

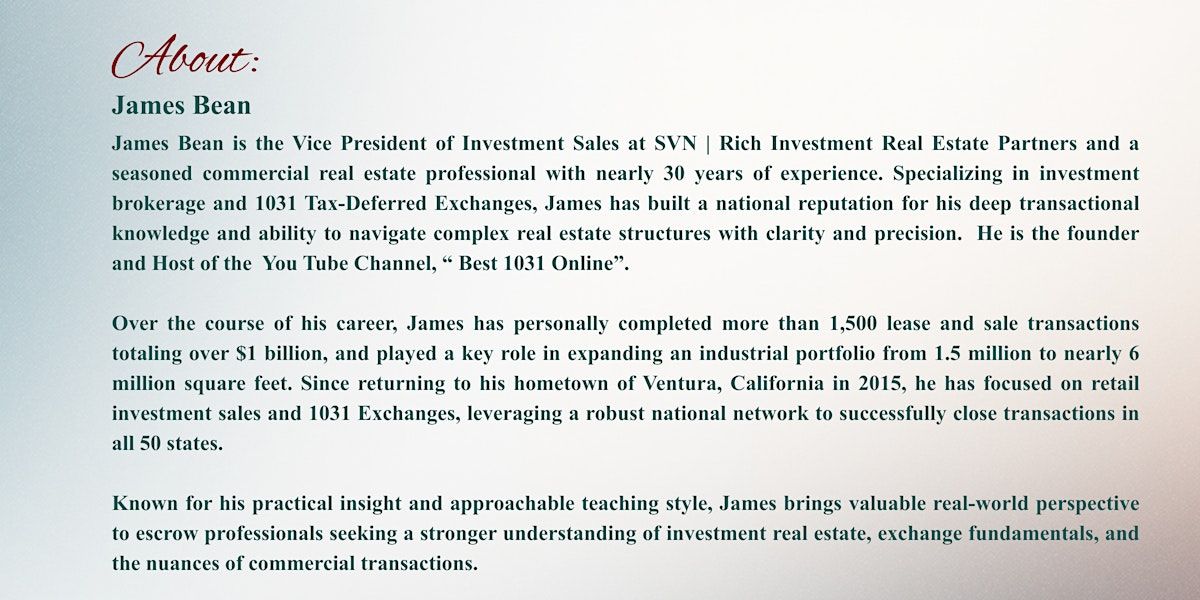

This hands-on course demystifies the 1031 Exchange for professionals in the title and escrow community. While the 1031 Exchange is a tax-driven transaction, the success or failure of the exchange often hinges on accurate handling of escrow instructions, communication with the Qualified Intermediary (QI), and the timing of funds release.

Participants will gain the knowledge and confidence to recognize when an exchange is taking place, understand their limited but critical role, and communicate effectively with the QI, agents, and principals.

By the end of this 3-hour course, participants will be able to:

1. Define what a 1031 Exchange is and why it exists under IRS Code §1031.

2. Recognize the key documentation and communication requirements that affect title and escrow.

3. Identify the roles of the exchanger, QI, agent, lender, and escrow holder — and where their responsibilities begin and end.

4. Apply basic understanding of 1031 timelines to escrow procedures and disbursement timing.

5. Avoid common errors that jeopardize tax deferral or create liability for the escrow/title company.

6. Communicate accurately with all parties to ensure compliance, neutrality, and professionalism.

Who Should Attend: Title officers, escrow officers, transaction coordinators, assistants, processors, and closing staff.

Where is it happening?

RELAW, APC, 2535 Townsgate Road, Thousand Oaks, United StatesEvent Location & Nearby Stays:

USD 160.83