Crypto Tax MasterClass -Are You Ready for the Crypto Taxman? Scottsdale

Schedule

Mon Aug 22 2022 at 06:00 pm to Mon Oct 24 2022 at 07:30 pm

Location

Madison | Madison, WI

About this Event

The Taxation of Crypto from A to Z- What You Must Know

The world changed on May 22 , 2010 (known as Bitcoin Pizza Day) when Bitcoin was first used to purchase 2 pizzas. In just 13 short years everything changed:

The world had a new form of currency ( digital or virtual and not paper) and its meteroic rise as an alternative currency and new asset class gave rise to trillions of dollars of evolving transactions ranging from mining to alternative investments and a way to borrow money without banks.

What didn’t change was our tax laws, leaving no guidance for how this new world of finance would be taxed and how the taxation of crypto would be enforced.- New financial systems- same old tax rules!

In this Masterclass we will explore and cover everything you need to know about:

- How and if your Crypto activities may be subject to tax.

- Who is subject to US taxes?

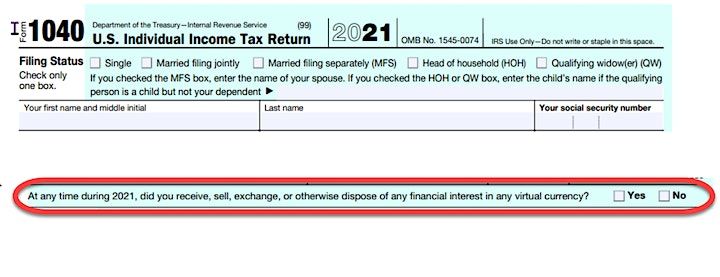

- What and when to report to the IRS.

- Penalites for non-compliance or coloring outside of the lines.

- Legal strategies for minimizing or deferring tax liability.

- How to simplify reporting all of your Crypto transactions.

This Masterclass is essential for anyone investing or trading or about to invest or trade in Crypto so that they will:

- Avoid a surprise tax bill that could exceed your profits or put you years behind in your wealth creation.

- Know how the IRS is stepping up its enforcement efforts and other things you need to be aware of.

- Be able to navigate the many conflicting IRS rules and regulations and plan accordingly.

What You Will Come Away With

- A comprehensive understanding of how taxes affect your crypto investments

- Ways to minimize your tax bill.

- What we can expect from the IRS in the days ahead

- Strategies that may work for you.

MasterClass Syllabus:

Part 1 The general tax treatment of Crypto

Part 2 The exceptions

Part 3 How Crypto is Taxed-Tax rates

Part 4 Who is subject to tax on their Crypto transaction

Part 5 Who is required to report their Crypto transactions

Part 6 Tax regulation and Taxpayer compliance

Part 7 Tax penalties for non-filing

Part 8 Planning OpportunitiesWhat to Expect:

Length: 1.5 hours

Questions and Answers to Follow

A slide deck and full recording of the Class with be sent to you after the program.

Follow Up questions with the Instructor availableAbout Me:

I am a retired tax lawyer. I hold a Masters in Tax Law from New York University School of law (1974) and practiced tax law for about 10 years in New York City. I specialized in structuring tax advantaged transactions, pension law and personal tax planning.

For over 30 years I have been a businessman, entrepreneur, and consultant to many businesses. Over the course of my career I have traded various financial instruments including stocks, options, 4x and futures. I became particularly interested in the Crypto markets when I recognized the world changing potential of Crypto.

I quickly realized that there was a real gap in the understanding of how Crypto would be taxed. Crypto was an entirely new industry with nothing but old laws to guide its participants. That’s when my passion for teaching kicked in as I realized that I could help people understand and navigate the myriad of confusing rules and regulations around Crypto.

More about Rafael https://www.eventbrite.com/o/rafael-stuchiner-35528529913 and his

Other Eventbrite Classes https://cryptomadesimple.us/rafaels-masterclass/ and his

Company, Crypto Made Simple https://cryptomadesimple.us

Where is it happening?

Madison, United StatesEvent Location & Nearby Stays:

USD 39.00